Contact Info

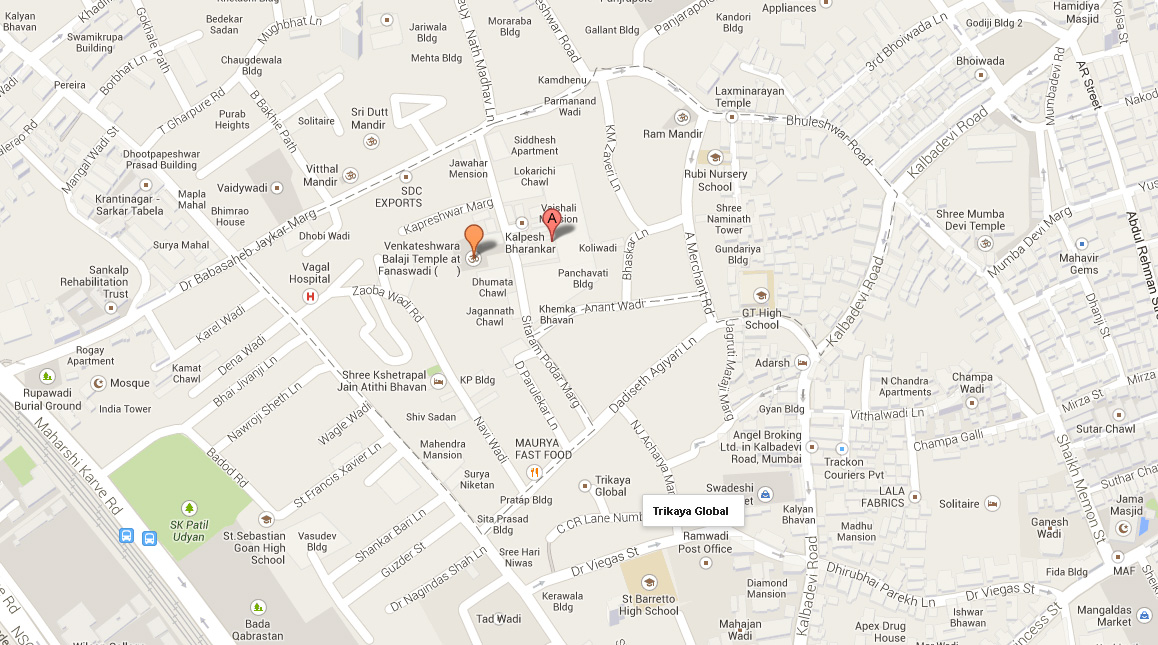

Head Office

29, 2ND Fanaswadi,

Venkatesh Building,

2ND Floor, Room No. 12 - A,

Mumbai - 400 002

Bombay Mutual Bldg., 1ST Floor,

D.N. Road. Above CitiBank

Fort

Mumbai - 400 001

Email ID: info@pravinjain.com

Phone: +91-22-2201 3005

Fascimile: +91-22-2208 0338